ETF vs mutual fund decisions have become crucial for investors in Pakistan seeking optimal returns. Over the past year, one particular ETF has outperformed all major indices, delivering an impressive return of around 72% to its investors. This exceptional performance highlights why ETFs have become increasingly popular among investors for their flexibility, low costs, and diversification benefits.

When comparing ETF in Pakistan options with traditional mutual funds, the differences extend beyond just returns. ETFs typically have lower expense ratios compared to mutual funds due to their passive management approach, which ultimately impacts your bottom line. However, globally, investors are shifting from active funds to passive investing through ETFs, suggesting a broader trend worth considering.

In this comprehensive guide, we’ll explore the ETF vs mutual fund comparison, examining which option might make more money for your specific situation. We’ll analyze everything from trading mechanisms to performance trends, helping you make an informed decision about which investment vehicle aligns with your financial goals in Pakistan’s unique market environment.

ETF vs Mutual Fund: Core Differences Explained

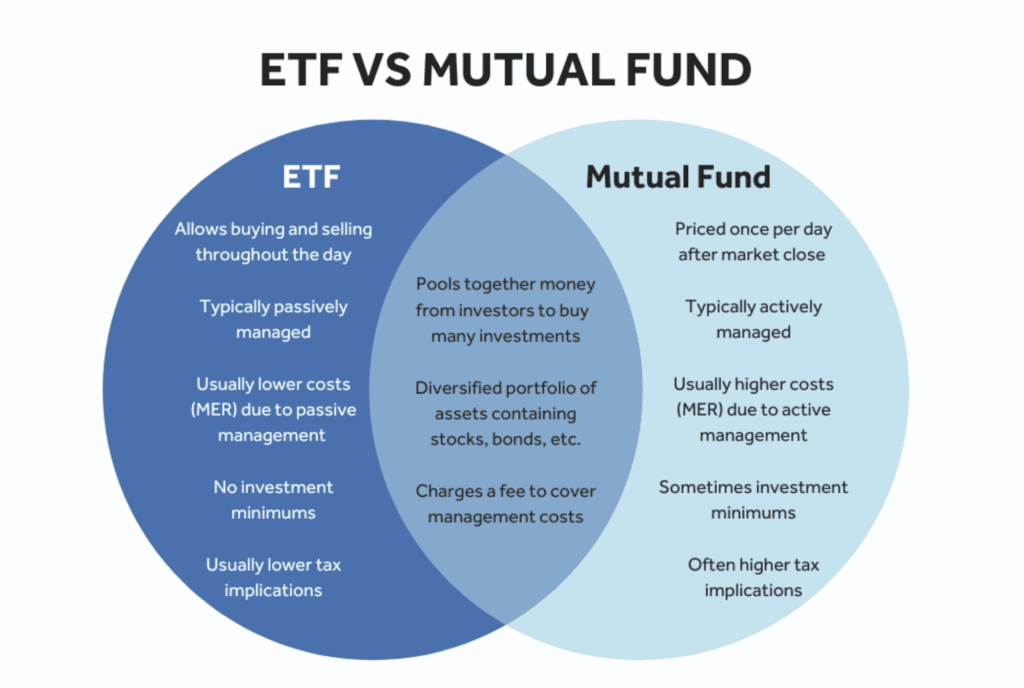

Understanding the fundamental differences between ETFs and mutual funds is essential before deciding which investment vehicle suits your financial goals. These differences span across several key aspects of how they operate and can be accessed.

Trading Mechanism: Intraday vs End-of-Day Pricing

The trading approach represents one of the most significant distinctions between these investment vehicles. ETFs trade on stock exchanges throughout the day with prices that fluctuate in real-time based on market supply and demand. In contrast to this dynamic pricing, mutual funds are priced just once per day after market closure, typically around 4 p.m. ET, based on their Net Asset Value (NAV). This fundamental difference means all mutual fund investors transacting on the same day receive identical pricing regardless of when they placed their orders.

Management Style: Passive Indexing vs Active Management

Most ETFs employ a passive management strategy, tracking specific market indices such as the Standard & Poor’s 500. This approach generally results in lower management costs since there’s no need for extensive research or frequent trading decisions. Conversely, mutual funds predominantly utilize active management, where fund managers actively select securities with the goal of outperforming benchmark indices. This active approach involves comprehensive research, market forecasting, and expert decision-making.

Minimum Investment: Share-Based vs Unit-Based Entry

ETFs offer greater accessibility through their share-based structure, allowing investors to purchase as little as one share. This translates to entry points as low as PKR 277.68 in some cases. Alternatively, mutual funds typically establish flat minimum investment requirements—often between PKR 138,840.86 to PKR 1,388,408.59—regardless of the fund’s per-unit price.

Liquidity and Access: Stock Exchange vs Fund House

ETFs provide superior liquidity through their exchange-traded nature, allowing investors to utilize sophisticated order types including limit orders and stop losses. Additionally, their dual-market structure enables trading on both secondary markets (exchanges) and primary markets. Mutual funds, meanwhile, must be purchased directly through fund companies or distributors, with transactions processed only at the end of each business day.

Cost and Fee Structure in Pakistan

Image Source: Al Meezan Investments

The fee structure often determines how much of your investment returns actually reach your pocket. Understanding these costs is essential for making informed investment decisions in Pakistan’s market.

Expense Ratios: ETFs vs Mutual Funds

ETFs in Pakistan typically feature lower expense ratios primarily because of their passive management approach. Indeed, actively managed mutual funds can have expense ratios up to 2% annually, whereas ETFs generally maintain significantly lower fees. This difference stems from ETFs’ “set and forget” investment philosophy that requires less active management.

Front-End and Back-End Loads in Mutual Funds

Notably, Pakistani mutual funds often charge front-end loads of up to 3% when investors approach fund houses directly. For online transactions, this fee may decrease to approximately 1.5%. Furthermore, back-end loads apply when selling mutual fund shares, calculated as a percentage of either the original investment or redemption value. For instance, a PKR 5,553,634 investment with a 5% front-end load would immediately reduce your initial investment by PKR 277,682.

Tax Efficiency: Capital Gains and Distributions

ETFs offer superior tax efficiency over mutual funds. Essentially, ETFs generate fewer capital gains distributions because of their unique creation/redemption mechanism. Consequently, ETF holders typically face lower tax bills annually. For mutual funds, frequent trading by fund managers creates more taxable events.

ETF vs Mutual Fund Calculator: Estimating Net Returns

To accurately compare potential returns, one must account for all fees, taxes, and distributions. An ETF vs mutual fund calculator should incorporate expense ratios, front/back-end loads, and tax implications to provide a realistic estimation of net returns over time.

Performance Trends in Pakistan (2023–2026)

Recent performance data reveals fascinating trends in Pakistan’s investment landscape. The ETF market has demonstrated remarkable growth alongside traditional mutual fund options.

JSMFETF vs MICF: Return Comparison

JS Momentum Factor ETF delivered an extraordinary 72% return in 2023, outperforming all major indices. Nevertheless, 2025 brought different results with a 9.1% year-to-date decline. Over the longer term, JSMFETF has outperformed the KSE All Share Index in 51% of months across 20 years of testing. In comparison, Mahaana Islamic Cash Fund (MICF) has shown more moderate but stable returns, primarily due to its focus on low-risk investments like Shariah-compliant securities and bank placements.

Volatility and Risk Metrics: Beta and Sharpe Ratio

Although JSMFETF exhibits higher volatility (11.4%) versus the broader index (7.4%), its Sharpe ratio of 1.59 exceeds the All Share Index’s 1.25. Throughout Pakistan’s fund industry, most investments maintain beta values below 1, indicating generally defensive positioning against market fluctuations. Overall, mutual funds have outperformed the market proxy by 0.86%.

Shariah-Compliant ETF Performance: MIIETF Overview

Launched in March 2024, Mahaana Islamic Index ETF (MIIETF) tracks Pakistan’s top 30 Shariah-compliant companies. MIIETF has maintained 100% active trading days since inception, showing consistent investor confidence. Alongside MZNPETF, these Islamic ETFs have performed well, boosted by transparency and increased retail interest.

Which Option Suits You Best?

Image Source: Collidu

Selecting between ETFs and mutual funds depends primarily on your unique investment objectives and time horizon. Let’s examine which option might align with your specific needs.

For Long-Term Passive Investors

ETFs typically serve as excellent core portfolio holdings for long-term investors. With lower expense ratios and tax efficiency, they provide straightforward market exposure without active management costs. If your investment horizon spans five to ten years, ETFs offer an opportunity for growth while minimizing expenses that could otherwise erode returns over time.

For Active Traders and Tactical Allocators

If you trade actively, ETFs provide flexibility through intraday pricing, limit orders, and stop-loss capabilities. Alternatively, mutual funds may appeal if you prefer specialized active strategies managed by professionals attempting to outperform benchmark indices.

For Ethical Investors: Shariah-Compliant Choices

Pakistan offers several Shariah-compliant investment options. MIIETF tracks the performance of top 30 Shariah-compliant companies, while MZNPETF was the first Shariah-compliant ETF listed on PSX. These funds adhere to Islamic principles, avoiding businesses involved in prohibited activities.

Diversification Needs: Broad Market vs Sectoral Exposure

Total market funds provide exposure across the entire market, offering built-in diversification. Alternatively, sector funds focus on specific industries like technology or healthcare, carrying higher potential returns alongside increased volatility risk.

Comparison Table

| Feature | ETFs | Mutual Funds |

| Trading Mechanism | Real-time pricing throughout trading day | Once per day pricing after market closure (4 p.m. ET) |

| Management Style | Primarily passive, tracking market indices | Predominantly active management with security selection |

| Minimum Investment | As low as one share (From PKR 277.68) | PKR 138,840.86 to PKR 1,388,408.59 |

| Expense Ratios | Lower due to passive management | Up to 2% annually |

| Trading Access | Stock exchange with multiple order types | Direct through fund companies/distributors |

| Front-End Load | Not mentioned | Up to 3% direct, 1.5% for online transactions |

| Tax Efficiency | Higher due to fewer capital gains distributions | Lower due to frequent trading and distributions |

| Liquidity | High (intraday trading, limit orders, stop losses) | End of business day processing only |

| Notable Performance | JSMFETF: 72% return (2023) | Outperformed market proxy by 0.86% |

| Risk Metrics | JSMFETF: 11.4% volatility, Sharpe ratio 1.59 | Beta values generally below 1 |

Final Thoughts?

The comparison between ETFs and mutual funds in Pakistan reveals significant differences that directly impact investment returns. ETFs generally offer lower expense ratios, greater tax efficiency, and intraday trading flexibility compared to mutual funds. Meanwhile, mutual funds provide professional management and specialized strategies that might appeal to certain investors.

Performance data from 2023-2026 clearly demonstrates how these investment vehicles behave differently in Pakistan’s market. JSMFETF’s remarkable 72% return in 2023 showcases the potential upside of ETF investing, though its subsequent volatility highlights the importance of long-term perspective. Consequently, your investment timeline and risk tolerance should guide your decision between these options.

Cost considerations undeniably play a crucial role in determining your actual returns. Front-end loads of up to 3% with mutual funds can significantly erode initial investments, while ETFs typically avoid these fees altogether. Similarly, the compounding effect of lower expense ratios with ETFs creates substantial differences in returns over time.

We believe the ideal choice depends entirely on your specific financial goals and preferences. Long-term passive investors might benefit more from ETFs’ cost efficiency and tax advantages. Alternatively, those seeking specialized strategies or active management might find certain mutual funds worth the additional costs. Check our latest article on Investment for additional insights that could further guide your decision-making process.

Therefore, whether you choose ETFs or mutual funds, understanding these fundamental differences enables you to make informed decisions aligned with your financial objectives. The Pakistan market offers viable options in both categories, with Shariah-compliant choices available for ethical investors as well. Your investment success ultimately depends less on which vehicle you choose and more on how well it aligns with your specific needs, time horizon, and risk tolerance. For more deep dives into wealth management and smart saving strategies, check out our blog for more insider secrets.

Popular Comments