What is Accounting and Finance?

In the world of business, the twin pillars of accounting and finance stand as critical foundations for any successful organization. My journey into this fascinating world began with a curiosity about how businesses manage their resources and make financial decisions. Accounting, often referred to as the “language of business,” is the systematic process of recording, analyzing, and presenting financial transactions.

Finance, on the other hand, is the art and science of managing money. Both disciplines are intertwined, each feeding into and expanding upon the other. Understanding them is akin to learning a language that allows us to interpret the economic activities of an organization and forecast its future.

The significance of accounting and finance extends beyond mere record-keeping and financial management. They serve as essential tools for strategic planning, providing insights that inform decision-making processes at all levels of an organization. As we delve deeper into this guide, we will explore the nuances of these fields, shedding light on their importance and the impact they have on business operations.

My aim is to demystify the complexities of accounting and finance, making them accessible to everyone from aspiring professionals to seasoned veterans looking for a refresher. Whether you’re a student contemplating a career in these fields or a business owner seeking to enhance your financial acumen, this guide will provide a comprehensive overview of the essential concepts, practices, and tools that underpin the art of accounting and finance.

Importance of accounting and finance in business

The role of accounting and finance in business cannot be overstated. At its core, accounting provides the framework for tracking an organization’s financial health, offering a snapshot of its performance at any given moment. This information is crucial for stakeholders, including investors, creditors, and management, who rely on accurate financial data to make informed decisions.

Finance goes a step further by taking the information provided by accounting and using it to plan for the future. It encompasses financial planning, investment analysis, and risk management — aspects that are essential for sustaining and growing a business. Together, accounting and finance empower businesses to maximize their resources, manage risks, and achieve their objectives efficiently.

Understanding and effectively managing the finances of a business can mean the difference between success and failure. In today’s competitive landscape, the strategic allocation of financial resources can provide a competitive edge, enabling businesses to innovate, expand, and thrive. This underscores the importance of mastering the principles of accounting and finance, not just for accountants and finance professionals, but for anyone involved in the management of a business.

Key principles of accounting and finance

The world of accounting and finance is governed by a set of fundamental principles that ensure clarity, consistency, and transparency in financial reporting. One of the cornerstone concepts is the accrual basis of accounting, which dictates that transactions should be recorded when they occur, regardless of when cash changes hands. This principle ensures that financial statements accurately reflect the economic activity of a business, providing a realistic picture of its financial health.

Another vital principle is the concept of going concern, which assumes that a business will continue to operate indefinitely. This assumption underlies many accounting practices and allows for the deferral of certain expenses and revenues, based on the expectation of future economic benefit.

The principle of conservatism, meanwhile, advises that in the face of uncertainty, businesses should opt for the most cautious financial estimates. This protects against the overstatement of assets or income, ensuring that stakeholders have a realistic understanding of a company’s position.

These principles, among others, form the bedrock of accounting and finance practices, guiding professionals as they navigate the complexities of financial management and decision-making. Adhering to these principles ensures the integrity and reliability of financial information, which is indispensable for maintaining trust among investors, creditors, and other key stakeholders.

Types of accounting and finance jobs

The fields of accounting and finance offer a diverse array of career paths, each with its unique focus and set of responsibilities. Public accountants, for example, provide auditing, tax, and consulting services to businesses, nonprofits, and government entities. Their work ensures that financial statements are accurate and comply with laws and regulations.

Corporate accountants, on the other hand, work within companies to manage their internal finances. This includes preparing financial statements, overseeing budgets, and ensuring the financial integrity of the organization. Finance professionals in corporate settings may also delve into financial analysis, helping to guide investment decisions and strategic planning.

For those with a penchant for investment and portfolio management, careers in finance such as financial analysts and investment advisors offer the opportunity to analyze market trends and advise clients on financial strategies. These roles require a deep understanding of financial markets and instruments, as well as the ability to forecast economic conditions and assess risk.

The diversity of roles within accounting and finance means that individuals can find a niche that aligns with their interests and strengths, from forensic accounting to financial planning. Each career path offers unique challenges and rewards, contributing to the overall efficiency and success of the businesses and clients they serve.

Skills required for a successful career in accounting and finance

A successful career in accounting and finance is built on a foundation of strong analytical and mathematical skills. Professionals in these fields must be able to interpret complex financial data and make informed decisions based on their analysis. Attention to detail is crucial, as is the ability to see the bigger picture and understand how financial decisions impact the overall strategy of a business.

Communication skills are equally important. Accountants and finance professionals must be able to convey complex information clearly and persuasively to others, including colleagues, clients, and stakeholders who may not have a financial background. This requires not only a deep understanding of the subject matter but also the ability to tailor the message to the audience.

In addition to these core skills, adaptability and a willingness to continue learning are essential. The financial landscape is constantly evolving, with new regulations, technologies, and practices emerging regularly. Staying abreast of these changes and understanding how they affect your work is crucial for maintaining your expertise and providing the best advice to businesses and clients.

Educational qualifications and certifications in accounting and finance

Pursuing a career in accounting and finance typically begins with obtaining a relevant degree, such as a Bachelor’s in Accounting, Finance, or a related field. This foundational education provides a comprehensive overview of key concepts and practices, from financial accounting and reporting to investment analysis and risk management.

For those looking to further distinguish themselves and advance their careers, professional certifications offer a pathway to specialized knowledge and recognition within the field. The Certified Public Accountant (CPA) designation is one of the most prestigious certifications for accountants, signifying expertise in financial reporting, auditing, and taxation. Finance professionals, meanwhile, may pursue certifications such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP), which demonstrate proficiency in investment management, financial planning, and analysis.

In addition to formal education and certifications, practical experience is invaluable. Internships and entry-level positions provide hands-on experience, allowing you to apply theoretical knowledge in real-world settings. This combination of education, certification, and experience equips aspiring accountants and finance professionals with the skills and knowledge needed to excel in their chosen careers.

Tools and software for effective accounting and finance management

In today’s digital age, proficiency with accounting and finance software is indispensable. These tools not only streamline and automate routine tasks but also provide advanced analytical capabilities, enabling professionals to glean deeper insights from financial data.

Accounting software like QuickBooks and Xero are widely used for managing business finances, offering features such as invoicing, payroll, and financial reporting. For more complex financial analysis and modeling, Microsoft Excel remains a staple, though specialized software like SAP and Oracle Financial Services provide more robust solutions for larger organizations.

Finance professionals also leverage tools for portfolio management, risk assessment, and market analysis. Bloomberg Terminal and Morningstar, for example, offer comprehensive financial data and analysis tools that support investment decision-making. Familiarity with these tools and the ability to harness their capabilities can significantly enhance the efficiency and effectiveness of accounting and finance functions.

Financial statements and reports

Financial statements and reports are the primary means by which businesses communicate their financial performance and position to stakeholders. The balance sheet, income statement, and cash flow statement are the core financial statements, each providing different but complementary views of a business’s finances.

The balance sheet offers a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial stability and liquidity. The income statement, on the other hand, shows the company’s revenues, expenses, and profits over a period, reflecting its operational efficiency and profitability. The cash flow statement tracks the flow of cash in and out of the business, providing insights into its liquidity and cash management practices.

Together, these statements provide a comprehensive picture of a company’s financial health, informing decisions made by investors, creditors, and management. Mastery of financial reporting and analysis is therefore crucial for accounting and finance professionals, enabling them to interpret these documents accurately and advise on strategic financial management.

Budgeting and forecasting in accounting and finance

Budgeting and forecasting are essential tools for financial planning and control, helping businesses to allocate resources efficiently and prepare for the future. Budgeting involves creating a detailed plan that outlines expected revenues and expenditures for a specific period, serving as a roadmap for financial decision-making.

Forecasting, meanwhile, uses historical data and market analysis to predict future financial trends and outcomes. This forward-looking approach allows businesses to anticipate changes and make informed decisions about investments, expansions, and other strategic initiatives.

Both processes require a thorough understanding of the business’s financial dynamics and the external factors that can impact its performance. Effective budgeting and forecasting can help businesses to manage risks, capitalize on opportunities, and achieve their financial goals, underscoring the importance of these skills for accounting and finance professionals.

Investment and risk management in accounting and finance

Investment and risk management are critical aspects of financial strategy, involving the assessment and mitigation of financial risks to maximize returns. This includes diversifying portfolios, hedging against market volatility, and implementing strategies to protect against credit, liquidity, and operational risks.

Understanding the principles of investment theory and risk management enables finance professionals to advise businesses and individuals on how to grow their assets while minimizing exposure to financial downturns. This requires not only a deep knowledge of financial markets and instruments but also the ability to analyze economic trends and assess the potential impact on investments.

Effective investment and risk management strategies can significantly enhance a business’s financial performance and resilience, making these skills invaluable for finance professionals looking to contribute to the success of their organizations or clients.

Ethics and regulations in accounting and finance

Ethics and regulations play a pivotal role in accounting and finance, ensuring that businesses operate with integrity and transparency. Ethical principles guide the conduct of professionals, dictating their responsibilities to clients, employers, and the public. These principles are enforced through regulations and standards set by governing bodies, such as the Financial Accounting Standards Board (FASB) and the Securities and Exchange Commission (SEC).

Compliance with these regulations is not just a legal requirement; it is fundamental to maintaining trust and confidence among investors, creditors, and the broader market. Violations can lead to severe consequences, including financial penalties, legal action, and reputational damage.

For accounting and finance professionals, adherence to ethical standards and regulatory requirements is paramount. This commitment to integrity and accountability is what upholds the credibility of the financial reporting process and ensures the smooth functioning of financial markets.

Emerging trends in accounting and finance

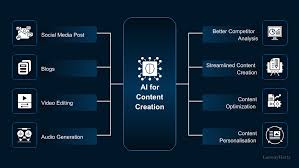

The fields of accounting and finance are continually evolving, shaped by technological advancements, regulatory changes, and shifts in global economic conditions. Automation and artificial intelligence (AI) are transforming traditional practices, streamlining processes, and enabling more sophisticated analysis. This digital transformation is not only changing the way professionals work but also the skills required to succeed in these fields.

Sustainability and social responsibility are also emerging as important considerations, influencing investment decisions and financial reporting. Businesses are increasingly being evaluated on their environmental, social, and governance (ESG) performance, alongside their financial metrics. This shift reflects a broader recognition of the role businesses play in addressing global challenges, such as climate change and inequality.

Staying abreast of these trends and understanding their implications is crucial for accounting and finance professionals. Embracing change and adapting to new practices will be key to navigating the future of these fields and contributing to the sustainable growth of businesses and the economy.

Resources for further learning in accounting and finance

For those interested in deepening their understanding of accounting and finance or keeping up with the latest developments, a wealth of resources is available. Academic journals, industry publications, and professional associations offer insights into current research, trends, and best practices. Websites and online courses also provide accessible platforms for learning new skills and concepts, catering to a range of experience levels.

Networking with peers and attending conferences and seminars can also be invaluable, offering opportunities to exchange knowledge and stay connected with the professional community. Whether you’re just starting your career or looking to expand your expertise, engaging with these resources can enrich your understanding and enhance your capabilities in accounting and finance.

Journey of Accounting and Finance

Mastering the art of accounting and finance is a journey of continuous learning and adaptation. These fields are fundamental to the success of businesses and the functioning of economies, playing a critical role in decision-making processes and strategic planning. The principles, practices, and tools we’ve explored in this guide provide a foundation, but true mastery comes from applying this knowledge in the real world, staying abreast of emerging trends, and adhering to ethical standards.

As we navigate the complexities of these disciplines, let us embrace the challenges and opportunities they present. By doing so, we can contribute to the growth and sustainability of businesses and make a positive impact on the world around us. Whether you’re an aspiring professional or a seasoned expert, the journey in accounting and finance is one of endless potential and rewards.

Don’t miss out—subscribe to our newsletter or follow us on social media for timely updates on our forthcoming articles.

Popular Comments